Living Trusts are Essential

“Our Living Trusts experience with Tom Tuohy was five stars; from the moment that we walked into his office and met his staff, and then talked to Tom, it felt like we were with friends. My wife and I have been wanting to get our estate planning done for many years, and we were happy that we found Tuohy Law to have it completed finally. Thank You.” –George Zaccagnini

What are Living Trusts?

A Living Trust is an estate plan that manages your assets during your lifetime. Your Trust then efficiently and inexpensively passes your estate to your chosen beneficiaries after your death. A Living Trust also known as an “Intervivos Trust” or “Revocable Trust.”

What is Probate?

Probate is a division of the court system that handles the estates of everyone who can either not handle their affairs because of a physical or mental disability or who has died. It protects your assets during your lifetime and supervises your estate’s proper administration and distribution at your death.

Why would you need a Living Trust?

To control and protect your estate, now and after your death.

By law, no one can sign your name. Therefore if you acquire a disability, your name can only be signed using a previously executed Financial Power of Attorney. On the other hand, when you die, an Executor appointed by a Probate judge can only sign your name.

Your Financial Power of Attorney revokes by operation of law at your death. Consequently, Probate is required if you have assets in your name after your death, such as title to real estate or financial institution accounts.

A Last Will and Testament does not avoid Probate. To clarify, a Will states your wishes for an Executor who handles your estate and distributes your assets to your beneficiaries after your death in Probate. Moreover, a Probate Court judge appoints your Executor to sign your name and distribute your property.

What is wrong with Probate?

Probate is costly, takes a long time, and the number of cases in the system makes it inefficient and burdens families. Further, the Probate system cannot handle the estate of every person. If you have not made other provisions and you acquire a disability, your assets are subject to the control of the Probate court.

Your family must care for you under the direction of the court system. Therefore, if you die with assets in your name, and the total collective value of your assets exceeds $100,000, your entire estate is subject to the complete Probate process.

Probate requires a minimum six-month claims period, and the entire process can take 18 months to two years or more to complete.

How can you avoid Probate?

A properly drafted, signed, and funded Living Trust avoids Probate.

How do Living Trusts avoid Probate?

All assets in your name are retitled to the name of your Living Trust and are not subject to Probate. Your estate is administered privately and efficiently by your Successor Trustee, often one of your family members or a trusted friend. Consequently, your Trustee can also be a beneficiary of your Living Trust.

Transferring your assets to your beneficiaries can take only weeks or time.

What legal documents are in Living Trusts?

A complete Living Trust estate plan should include a Trust, a Last Will and Testament. Importantly, this type of Will is often called a Pour-Over Will, a safety net for assets not titled in your Trust at your death. In other words, this Will pours the assets in your name out of Probate and into your Trust. Your Living Trust estate plan should also have a Financial Power of Attorney and a Health Care Power of Attorney.

Are Living Trusts expensive?

No. Today, with the advantage of technology and a competent attorney, a Living Trust estate plan, complete with Power of Attorney documents and a Will, is reasonably priced and not much more than the cost of a Will. Importantly, you would avoid the thousands of dollars of Probate costs and the burden on your family.

What are the other advantages of Living Trusts?

Some of the many advantages of a Living Trust estate plan:

- Avoid Probate

- Protect you in the event of your disability

- Organize lifetime management of your assets

- Contains specific instructions for inheritance

- Protects the wishes of the first spouse to die

- Avoids the perils of joint tenancy

- Protects against loss of benefits or government reimbursement if a beneficiary acquires a disability before your death.

- Includes assets in all states and avoids multiple-state probate

- Contains a No-Contest clause

- Provides creditor protection for beneficiaries

- Is revocable

- Is easily amended

- Can readily be adapted to the laws of another state in the event you move

How can you obtain a Living Trust?

If you live in Illinois, consult an experienced Chicago Living Trust lawyer.

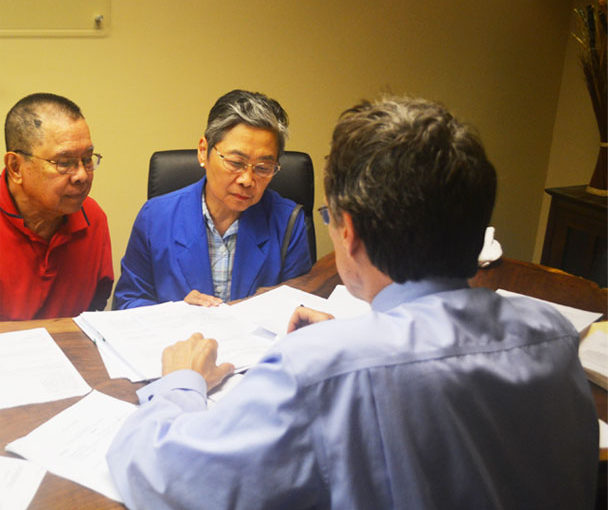

Tom Tuohy has prepared over 5,000 Living Trust estate plans and will personally prepare your documents and handle your signing in our convenient Oakbrook Terrace office.

I’ve included for you the estate planning forms below and a brochure.

Nearly every client who has completed their Living Trust estate plan expresses a sense of relief that they finally took care of this critical family protection. It is common to think about this for years. Now is the time to think about getting it done.

“Oh my GOD, I just left Tuohy Law Offices. I feel so good about the TRUST I open for my son. I think everyone who has underage children should have a Living Trust. Call Tom Tuohy today and have the stress lifted off your shoulders because you’ve done the right thing for your child. Don’t procrastinate! Do it today. I did.” – Marilyn Montgomery

Estate Planning Form

Asset Inventory Form

Estate Planning Brochure

Please click these links for detailed information regarding Power of Attorney, Last Will & Testament, and Probate.

Contacting us does not create an attorney-client relationship until such time as we acknowledge receipt and verify our client-attorney relationship in writing.

Health Care Power of Attorney and Kids